Acorns: Just nuts, or a good investment?

I recently downloaded the new Acorns App for iPhone. Numerous commentators and users were cautioning that it didn't make good financial sense, so after using it for a few days my skepticism and concern grew too great and I decided to check out the math on it.

Two disclaimers up front: I'm fairly new to investing, and I'm also not a financial advisor, so take what you read here with a grain of salt.

Fees

So the first thing to consider is the fees. According to the Acorns website:

$1 per month + 0.5% APY of balance + 0.25% APY of balances over $5K

They have a helpful tool on their website to estimate your fees to see what that looks like. If we put in $100 the monthly fee would be:

$100 starting balance = $1.04 per month in fees

At $100, the fee is a fairly hefty 1% of your account. If you only started out with $10, that $1/month would whittle away your account into nothing within a year. Those aren't very practical figures for investment though, and this isn't factoring in monthly contributions and interest earnings yet. Starting with something like $1,000 paints a very different picture, with the fee being $1.42 per month or less than 2/10ths of a percent.

What is also exciting is that is the only fee, and the account is actually quite liquid: "Invest on your schedule. Add or withdraw funds with a swipe, and with no fees or penalties"

Not sure what sort of voodoo they're doing on their end to keep the account so liquid, but I definitely appreciate it.

Comparing Fees

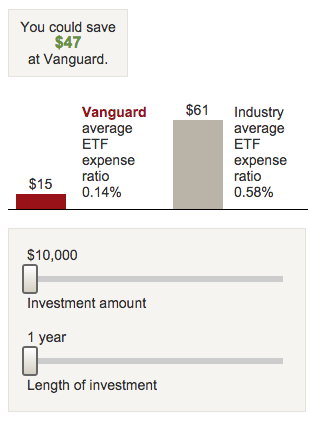

The fee for Acorns is really quite low compared to many other investment options, though the fee is high when compared to Vanguard's fees, especially for Vanguard's index funds which can be as low as 0.08%. Acorns charges you at least 6 times more!

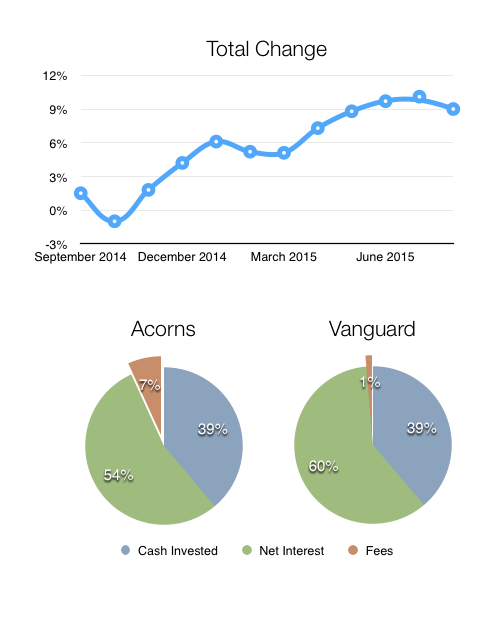

Consider the following scenario. You make a $10K investment. You can either make it in Vangaurd or in Acorns. You contribute $50 additional each month to whichever one you chose. Given identical growth in each, here is a breakdown of how much you would pay in fees:

In that scenario, you'd pay $20.72 on your Vangaurd account, while you'd pay $105.48 on your Acorns account over a one year period. Neither is particularly awful, but Vanguard would clearly save you quite a bit over Acorns. Project that out over just 10 years and you've already paid well over $2K in fees for Acorns, while not even breaching $300 at Vangaurd.

My estimate seems fairly realistic, given Vangaurd's own tool for estimating fees on its website shows figures within that range:

Acorns' fee structure seems to put it above the industry average expense ratio of 0.58% (as stated by Vanguard).

In any case, Acorns costs significantly more than Vanguard and is almost double the industry average. That being said, the money is very liquid, and charges you no additional fees or penalties.

I initially assumed that it would be unwise to leave $5K or more in your Acorns account due to the added fee at that level. However, according to the figures I got: the higher your balance is the lower that expense ratio gets. This holds true for balances below $5K as well, so it makes sense that the trend continues beyond that. Even so, taking your initial balance as high as $100K only gets you to an expense ratio around 0.8%, still nowhere close to industry average.

Checking the Math

I ran some numbers through some hypothetical situations to see what would be a worthwhile investment in acorns. My conclusion is that pretty much any account balance under $1000 is not worthwhile. This is not an issue unique to Acorns alone, as many investment accounts would earn very little or drown in fees at levels below that.

At the $100 level (+$5 per month), not only is there a very high likelihood that your expense ratio could be as high as 10%, but whatever meager interest you end up earning in typical market conditions, will be sunk by those fees. In other words, you are likely to lose money, or if you make any, it will be next-to-nothing. Your net interest earnings will likely be less than or very near 1%.

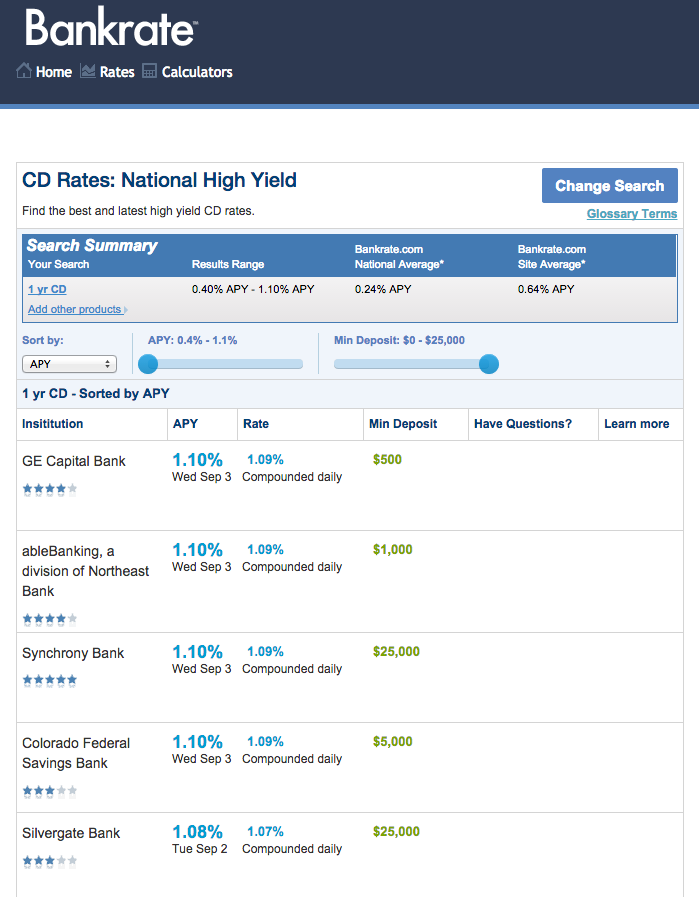

At this level, your money would be better off in a Certificate of Deposit, possibly even just a basic savings account. Even though both of those are at historically low (bad) interest rates, they still offer a higher rate than you'd get here, with the added bonus of no risk and often no fees.

At the $1,000 level (+$50 per month), the story is way better. Even though it is still worse than industry average, your expense ratio will likely float right around 1.4% (almost 10 times lower). In the scenario I tried out, you can earn over 7% on the account (that's after fees), which performs way better than just about any CD or savings account currently does.

Disclaimer: Keep in mind that this was just a hypothetical scenario which I modeled similarly to some indexes such as the S&P 500 and DJI. I have no idea what kind of growth you will actually see with Acorns. The figures on expense ratio are likely to remain similar regardless of actual performance, however.

App

The app itself is a brilliant experience. The interface is easy to use and actually has a few innovations I really love. This article isn't really a review of the UI/UX, so I won't spend a lot of time on the app right now, but I've got to say the app itself is killer. Its a big reason why I will probably use this investment vehicle as opposed to another with lower fees.

Other Considerations

I didn't even touch issues of taxes or detailed comparisons of investment options and their corresponding returns and fees. For the most part this was really about checking if Acorns could make you money and what you would have to do to achieve that.

I also have no idea how to properly evaluate the details of the portfolios Acorns offers. They diversify, and offer portfolio options based on risk levels, but that's about all I can say. Perhaps this makes Acorns better by more complex measures, or maybe it makes little difference.

Conclusion

Acorns claims to be a great service and tool for investing in small amounts at a low level. While it certainly makes investing at that level "accessible" and easy to use, the way they recommend using it may actually cost the user more than half of what they earn from it.

Balances less than $100, adding $5 or less per month after that, are probably far better off in a Certificate of Deposit.

According to an article by Dan Kadlec at Time, however, people quickly move past this phase in Acorns as the average account holder contributes $7 per day. Even though many people probably start out with balances less than $100 the average user finds themself at a much healthier level within just a few months.

The sweet spot for this service seems to start around balances of $1000 or more. This brings the expense ratio to under 2% and brings your potential interest to levels more likely to be useful (and noticeable).

Kadlec comments that if you are serious about investing your investment dollars will likely serve you better in an index fund such as the Vanguard S&P 500 ETF, or, paritcularly if you are young, investing in a tax-deferred 401(k) plan.

Acorns is an extremely well-made app and makes investing easy to do and easy to understand. If all you have to invest is spare change, or don't have the time to bother with slogging through hundreds of financial tables and forms, Acorns is probably a good idea. If you want to make a serious investment with a good deal of money though, you are probably better off putting your money (or at least more of your money) into other investment vehicles.

Disclaimer: I am not a Financial Advisor, nor does this article constitute financial advice. The article is merely my own evaluation of whether it seems like Acorn is a viable service and on what grounds it might be. I suggest you consult an actual advisor before making investment decisions.